Homeowners Insurance in and around Minneapolis

Looking for homeowners insurance in Minneapolis?

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

There’s No Place Like Home

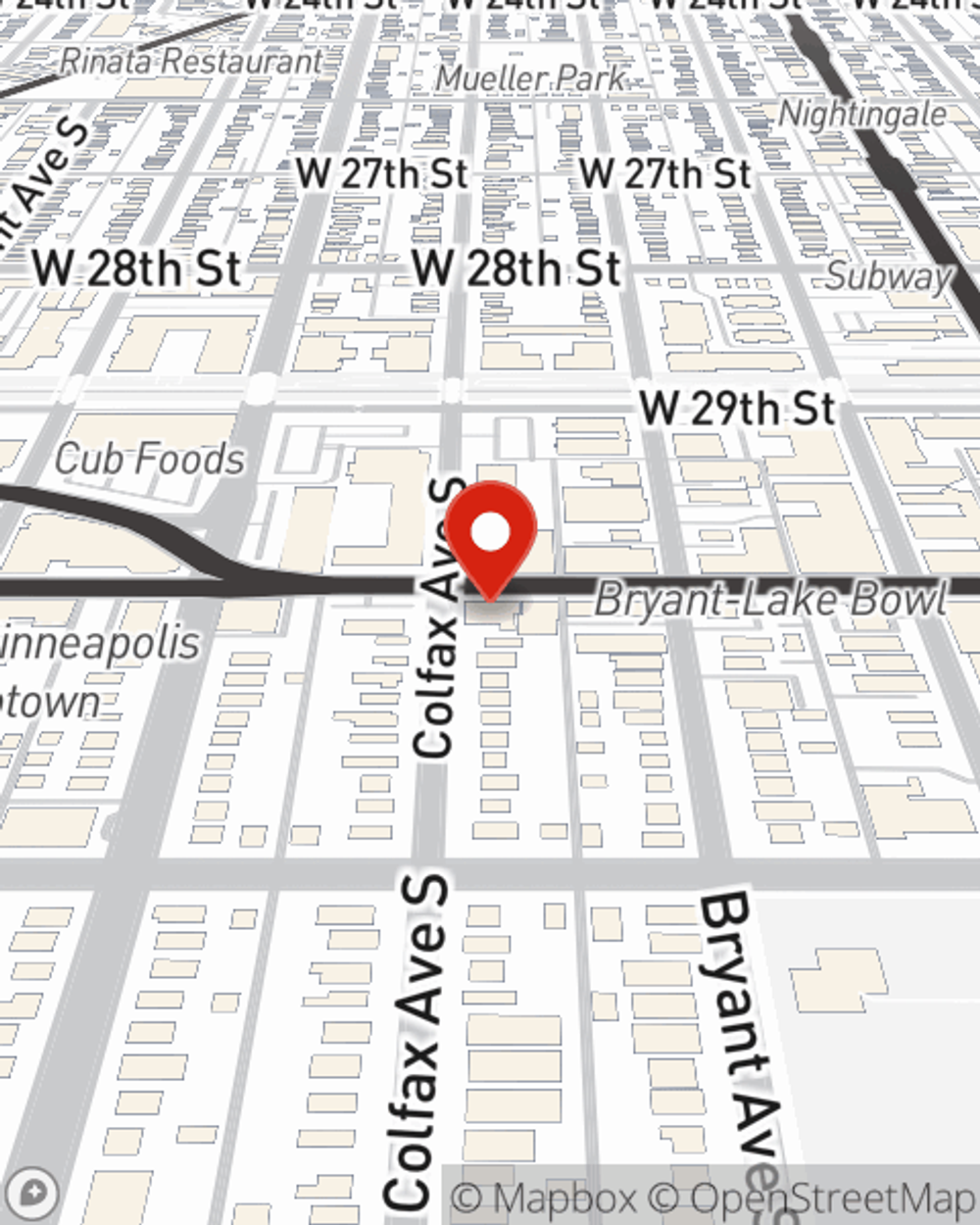

There are plenty of choices for home insurance in Minneapolis. Sorting through savings options and deductibles isn’t easy. But if you want great priced homeowners insurance, choose State Farm. Your friends and neighbors in Minneapolis enjoy unbelievable value and hassle-free service by working with State Farm Agent Lawrence Thomas. That’s because Lawrence Thomas can walk you through the whole insurance process, step by step, to help ensure you have coverage for your home as well as appliances, furniture, electronics, sound equipment, and more!

Looking for homeowners insurance in Minneapolis?

Give your home an extra layer of protection with State Farm home insurance.

Safeguard Your Greatest Asset

That’s why your friends and neighbors in Minneapolis turn to State Farm Agent Lawrence Thomas. Lawrence Thomas can help clarify your liabilities and help you find a policy that fits your needs.

There's nothing better than a clean house and insurance with State Farm that is commited and reliable. Make sure your home is insured by contacting Lawrence Thomas today!

Have More Questions About Homeowners Insurance?

Call Lawrence at (763) 710-2115 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

Radon gas in homes: What to know

Radon gas in homes: What to know

Radon gas is odorless, colorless and the second leading cause of lung cancer. These are some common methods for assessing, preventing or removing it.

Lawrence Thomas

State Farm® Insurance AgentSimple Insights®

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

Radon gas in homes: What to know

Radon gas in homes: What to know

Radon gas is odorless, colorless and the second leading cause of lung cancer. These are some common methods for assessing, preventing or removing it.